The real estate market in Myanmar is a vibrant and dynamic sector with significant growth potential. However, it faces numerous challenges that hinder its stability and development. From regulatory hurdles and economic instability to infrastructure deficiencies and socio-political issues, the path to a robust real estate market in Myanmar is fraught with obstacles.

This article delves into the major challenges facing Myanmar's real estate market, providing a comprehensive understanding of the complexities involved.

Regulatory and Legal Framework

One of the foremost challenges in Myanmar's real estate market is the regulatory and legal framework. The country's real estate laws are often viewed as outdated, ambiguous, and inconsistently enforced. Land ownership laws, in particular, pose significant difficulties. Foreign ownership of land is highly restricted, and there is a complex system of land classifications, including freehold, leasehold, and government-owned land. This complexity often leads to disputes and legal uncertainties, deterring both domestic and foreign investors.

Additionally, the lack of a comprehensive land registry system exacerbates these issues. Without a reliable database of land ownership and transactions, verifying property titles and conducting due diligence becomes a cumbersome process. This lack of transparency can lead to fraudulent activities and further erodes investor confidence.

Economic Instability

Myanmar's economy has faced significant turbulence in recent years, impacting the real estate sector. Political unrest, economic sanctions, and the COVID-19 pandemic have all contributed to economic instability. This uncertainty affects consumer confidence and reduces the purchasing power of potential property buyers. High inflation rates and fluctuating currency values also make it difficult for investors to predict returns on their investments.

Moreover, access to finance is a major hurdle. Myanmar's financial sector is still developing, and mortgage financing options are limited. High interest rates and stringent lending criteria make it challenging for individuals and businesses to secure loans for property purchases or development projects. This limited access to finance stifles demand and constrains the growth of the real estate market.

Infrastructure Deficiencies

The lack of adequate infrastructure is another significant barrier to the development of Myanmar's real estate market. Basic infrastructure such as roads, electricity, water supply, and sanitation is often lacking, particularly in rural areas. Even in urban areas like Yangon and Mandalay, infrastructure development has not kept pace with rapid urbanization.

This deficiency affects the attractiveness of real estate projects. Potential buyers and investors are hesitant to commit to properties in areas with poor infrastructure, leading to slower sales and lower property values. The government has recognized this issue and has initiated several infrastructure development projects. However, progress is often slow, and the scale of the challenge remains daunting.

Socio-Political Issues

Myanmar's socio-political landscape is another critical factor influencing the real estate market. Political instability, ethnic conflicts, and governance issues create an uncertain environment for property investment. The military coup in February 2021, for example, has led to widespread unrest and deterioration in the rule of law, severely impacting the business environment.

These socio-political issues not only affect investor confidence but also disrupt construction activities and property transactions. Curfews, internet blackouts, and supply chain disruptions have all had a negative impact on the real estate sector. Until there is a solution to these socio-political challenges, the real estate market is likely to remain volatile.

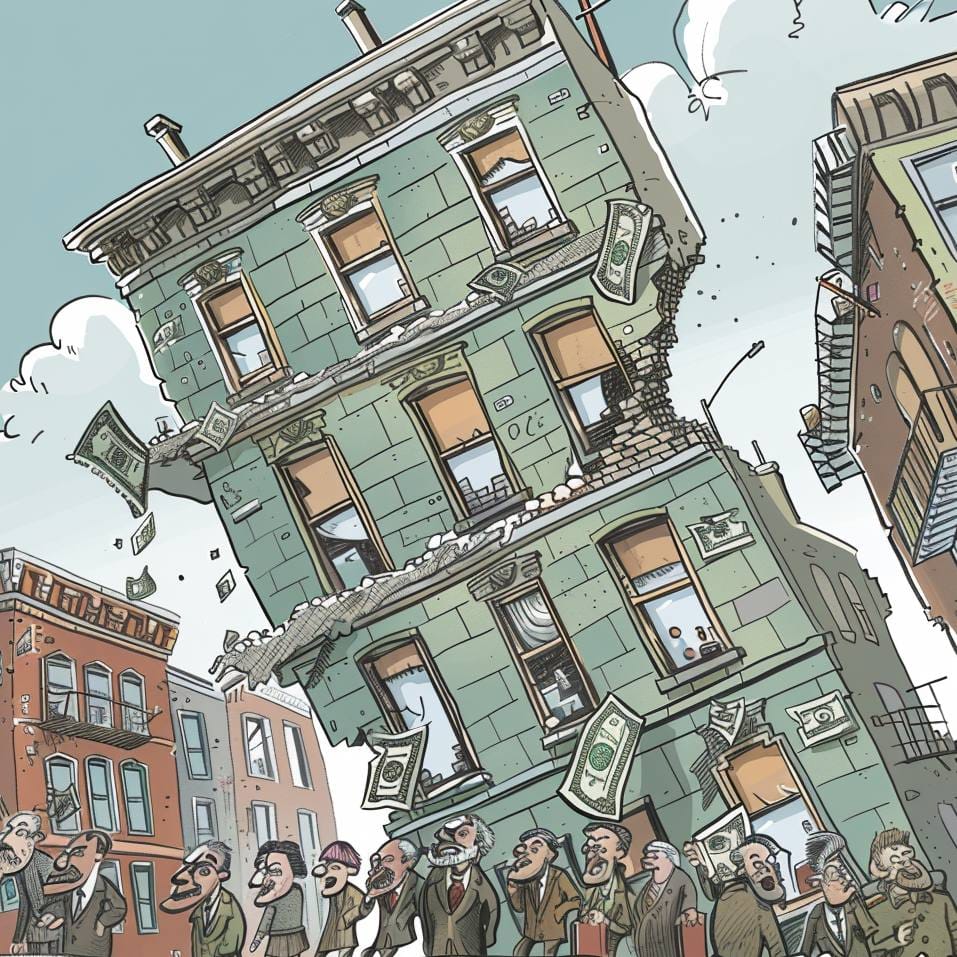

Market Speculation and Price Volatility

The Myanmar real estate market has also been characterized by significant speculation and price volatility. During periods of economic optimism, property prices have soared, often driven by speculative investments rather than genuine demand. This speculation creates bubbles that can burst, leading to sharp declines in property values and financial losses for investors.

Price volatility is further exacerbated by the lack of reliable market data. Accurate and up-to-date information on property prices, transaction volumes, and market trends is often scarce, making it difficult for investors to make informed decisions. The absence of a robust property valuation system also contributes to price discrepancies and market inefficiencies.

Interestingly, according to Thai Real Estate Information Center (REIC) data, Myanmar's wealthy elite have become significant buyers in the Thai property market. A publication by Collier Real Estate reports that buyers from Myanmar have purchased expensive real estate in major cities of Thailand.

Carlo Pobre, deputy managing director of Collier, stated that the Real Estate Information Center (REIC) of the Government Housing Bank revealed a large number of buyers and investors from Myanmar in Thailand's real estate market. He noted that Myanmar nationals prefer to buy real estate in Bangkok, Phuket, and Chiang Mai.

REIC data shows Myanmar citizens spent 2.25 billion baht in Thailand's real estate market last year, making them the third highest-spending buyers after Russian and Chinese nationals.

"Myanmar's wealthy people have bought expensive condos in major sites of Bangkok with prices ranging from 10 million baht to 20 million baht," Pobre added.

Environmental Challenges

Environmental challenges pose additional risks to Myanmar's real estate market. The country is prone to natural disasters such as cyclones, earthquakes, and floods, which can cause significant damage to property and infrastructure. Climate change is likely to increase the frequency and severity of these events, further impacting the property market.

Furthermore, environmental regulations and standards are still evolving in Myanmar. There is a need for more stringent building codes and environmental impact assessments to ensure that real estate development is sustainable and resilient to natural disasters. Implementing these measures will require collaboration between the government, developers, and other stakeholders.

The Way Forward

Addressing the challenges in Myanmar's property market requires a multifaceted approach. Regulatory reforms are essential to create a more transparent and investor-friendly environment. Simplifying land ownership laws, establishing a comprehensive land registry, and improving the enforcement of property rights can help reduce legal uncertainties and attract investment.

Economic stability is another critical factor. Strengthening the financial sector, expanding access to mortgage financing, and implementing policies to control inflation and stabilize the currency are necessary steps to support the real estate market. Infrastructure development should also be prioritized, with a focus on both urban and rural areas to ensure balanced growth.

Addressing socio-political issues is perhaps the most complex challenge. Achieving political stability and resolving ethnic conflicts will require long-term efforts and commitments from all stakeholders. In the meantime, measures to protect property rights and ensure the rule of law can help mitigate some of the immediate impacts on the real estate market.

Finally, promoting sustainable development and resilience to environmental challenges is crucial. Implementing and enforcing environmental regulations, investing in disaster-resistant infrastructure, and adopting green building practices can help ensure the long-term viability of Myanmar's real estate market.

While the challenges facing Myanmar's real estate market are significant, they are not insurmountable. With concerted efforts from the government, private sector, and international partners, it is possible to navigate these complexities and unlock the potential of Myanmar's real estate sector.

Last edited 1 minute ago