Despite ongoing internal challenges, Myanmar continues to offer attractive investment opportunities across various regions. This situation can be described as a mix of risks and rewards. If you're planning to start a business or make an investment in Myanmar, the following information should prove helpful.

A word of caution: This document is not intended to serve as business advice or guidance. Rather, it's an information-sharing exercise that presents official data that might be useful for those considering business ventures. If you're seriously planning to start a business in Myanmar, it's essential to first consult with business consultants, financial advisors, and lawyers.

Investment Policy

For foreign direct investment in Myanmar, it's crucial to understand the government's established policies. This will help you identify which sectors the government prioritizes and what activities are restricted. Here's a summary of key points from the investment policy:

Myanmar has 7 core investment policy principles:

- Myanmar welcomes responsible investments that provide mutual benefits

- The government machinery pledges to facilitate ease of doing business

- The country offers reliable dispute resolution mechanisms and a trustworthy banking system

- Promises to establish a non-discriminatory environment for both domestic and foreign investments

- Protection against arbitrary nationalization is guaranteed and enshrined in the constitution

- Allows legal transfer of profits abroad after tax obligations are met

- Permits long-term land leasing for foreign investments

Regarding investment responsibilities, both domestic and foreign businesses must equally comply with environmental protection regulations.

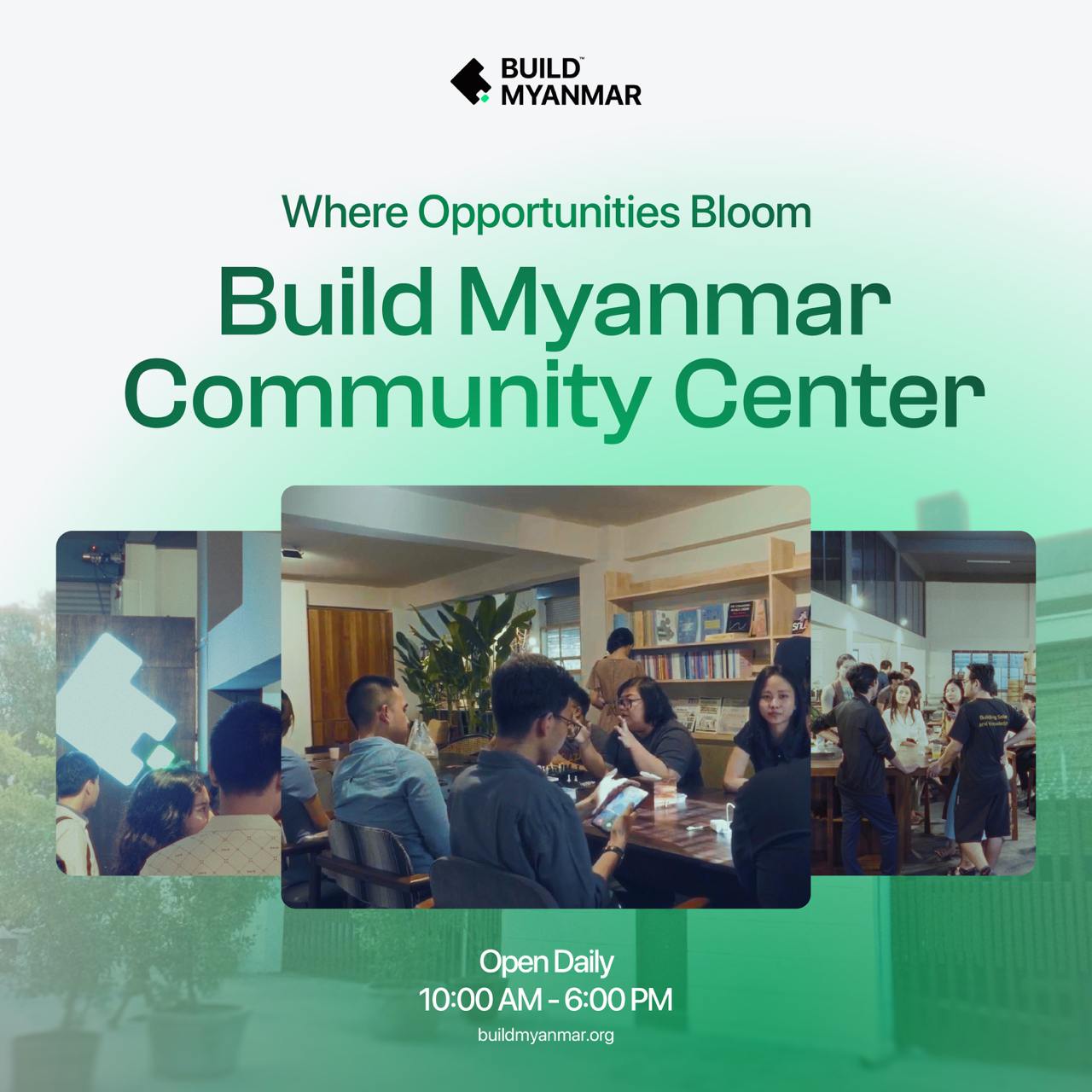

Where Opportunities Bloom

Myanmar – a place where creativity, learning, and connection come together. The Build Myanmar Community Center is the ultimate solution for youth seeking inspiration and opportunity.

This innovative center offers:

- Fully-equipped spaces with high-speed internet

- Flexible co-working areas for collaboration

- Networking opportunities

- Diverse workshops led by experts from various fields

- A comprehensive library for knowledge seekers

- Maker spaces to fuel creativity and innovation

Interested in transforming your potential? Explore the link below and discover a world of possibilities.

Activities related to cultural, social, and national security matters are restricted. Prohibited and restricted activities are detailed in Sections 41 and 42 of the Investment Law (2016).

The country welcomes:

- Value-added agricultural production

- Technology transfer initiatives

- SME development projects

- Investments in underdeveloped regions

- Industrial zone and special economic zone projects

- Tourism and related businesses

Government Guarantees

The government provides three specific guarantees for both domestic and foreign investments in Myanmar:

1. Protection Against Nationalization

In Myanmar's history, there was a period of nationalization under General Ne Win's regime, starting in 1963, when private businesses, including foreign-owned banks, oil companies, and other enterprises, were converted to state ownership. Learning from this economic downturn, Article 36(d) of the 2008 Constitution explicitly states "no economic enterprise shall be nationalized."

This guarantee is clearly stated in both Myanmar's 7-point investment policy and the government's assurance package.

2. Protection Against Arbitrary Business Suspension

The government pledges not to suspend investment operations without sufficient cause. "Sufficient cause" primarily refers to matters of national security, environmental damage, or issues affecting citizens' cultural practices and customs. Barring these exceptions, businesses are free to operate.

3. Right to Repatriate Original Foreign Currency Investment

Foreign investors in Myanmar are permitted to repatriate their initial investment in the original foreign currency (Dollar, Yuan, etc.). For example, if an investor's initial investment was in US dollars, they can transfer profits back in dollars. Similarly, investments made in Yuan can be repatriated in Yuan.

Income Tax Exemptions and Relief

Manufacturing or service businesses receive a five-year consecutive income tax exemption starting from the first year of commercial operation. For example, if a foreign direct investment business begins operations in 2025, they will enjoy tax exemption until 2029.

If profits are reinvested in the same business within one year as a reserve fund, the reinvested portion qualifies for income tax exemption or relief. For instance, if first-year profits are 100 million kyats and 1 million is reinvested alongside the original investment, the profits from this additional investment will qualify for complete exemption or relief.

For income tax assessment, depreciation of machinery, equipment, buildings, or other capital assets is calculated using state-prescribed depreciation rates and can be deducted from income tax. For example, if a rice mill's annual depreciation is 1 million kyats and the total income tax is 10 million kyats, the final tax payment would be 9 million kyats after depreciation deduction.

Export-oriented manufacturing businesses can receive up to 50% income tax relief on profits from exports.

Additionally, foreign nationals pay income tax at the same rates as domestic residents.

Income tax exemptions vary by zone, with details specified in Chapter 18, Section 74 of the Myanmar Investment Law.

Commercial Tax Relief or Exemption

Manufacturing businesses producing export goods may qualify for commercial tax relief or exemption.

Research and development costs for necessary business operations can be deducted from taxable income.

Customs Duty or Domestic Tax Relief

During the construction phase, businesses can receive relief or exemption from customs duties or other domestic taxes on imported machinery, equipment, spare parts, and construction materials necessary for the business.

International Agreements and Guarantees

Beyond tax incentives, Myanmar's participation in international investment agreements provides additional security for investors.

Myanmar has signed regional trade, investment, and economic cooperation framework agreements with:

- ASEAN+EU (1980)

- ASEAN+USA (2006)

- ASEAN+China (2002)

- ASEAN+India (2003)

- ASEAN+South Korea (2005)

Myanmar has also established bilateral investment promotion and protection agreements with:

- Singapore (2019)

- Israel (2014)

- Korea (2014)

- Japan (2013)

- Thailand (2008)

- Kuwait (2008)

- Laos (2013)

- China (2001)

- Vietnam (2000)

- Philippines (1998)

For those interested in investing in Myanmar, contact the Ministry of Investment and Foreign Economic Relations, Directorate of Investment and Company Administration for necessary information. Additionally, consulting with business and investment advisors can help identify valuable business opportunities.

By Linn Eain (Y3A)

Read More:

Build Myanmar - MediaY3A

Build Myanmar - MediaY3A

Build Myanmar - MediaY3A

Build Myanmar - MediaY3A

Build Myanmar-Media : Insights | Empowering Myanmar Youth, Culture, and Innovation

Build Myanmar-Media Insights brings you in-depth articles that cover the intersection of Myanmar’s rich culture, youth empowerment, and the latest developments in technology and business.

Sign up for Build Myanmar - Media

Myanmar's leading Media Brand focusing on rebuilding Myanmar. We cover emerging tech, youth development and market insights.

No spam. Unsubscribe anytime.

Sign up now to get the latest insights directly to your mailbox from the Myanmar's No.1 Tech and Business media source.

📅 New content every week, featuring stories that connect Myanmar’s heritage with its future.

📰 Explore more:

- Website: https://www.buildmyanmarmedia.com/

- Facebook: https://www.facebook.com/buildmyanmar

- YouTube: https://youtube.com/@buildmyanmarmedia

- Telegram: https://t.me/+6_0G6CLwrwMwZTIx

- Inquiry: info@buildmyanmar.org

#BuildMyanmarNews #DailyNewsMyanmar #MyanmarUpdates #MyanmarNews #BuildMyanmarMedia #Myanmarliterature #myanmararticle #Updates #Insights #Media